STANDARD AUDIT FILE – NEW VAT REQUIREMENTS

(UPDATE)

| As a result of the amendment to the Tax Law dated 13 May 2016 (signed by the President on 8 June 2016), taxpayers will be required to send data arising from VAT registers in the form of a standard audit file (SAF) on their own every month, without being requested by tax authorities to do so. It is a kind of expansion of the obligation taking effect on 1 July 2016 imposed on taxpayers to provide data in the form of the SAF at the tax authorities’ request. | |||||

|

WHAT IS SAF? |

SAF is a file that contains data from books of account, including accounting documents, saved in a specific manner, according to the pre-determined logic structure. Taxpayers keeping books of account in an electronic way will be required to provide data in the form of the SAF at the tax authority’s request. |

||||

|

OBJECTIVE |

SAF is to simplify and speed up the audit carried out by tax authorities. Due to automatic tests, unlawful reductions of the amount of tax to be paid are to be detected more effectively. SAF also aims to reduce arduousness related to tax audits: in many cases, tax audits would not need physical presence of tax authority representatives at the company’s office. |

||||

MONTHLY SAF REGARDING VAT (UPDATE) |

|||||

|

FORM |

As a result of subsequent amendment to the Tax Law dated 13 May 2016, taxpayers keeping books of account in an electronic form are required to provide tax authorities with data arising from VAT registers every month in the SAF form by the 25th day of a month following each month. An important thing is that the SAF must be sent regardless of whether the taxpayer files VAT returns monthly or quarterly. |

||||

|

WHO AND WHEN |

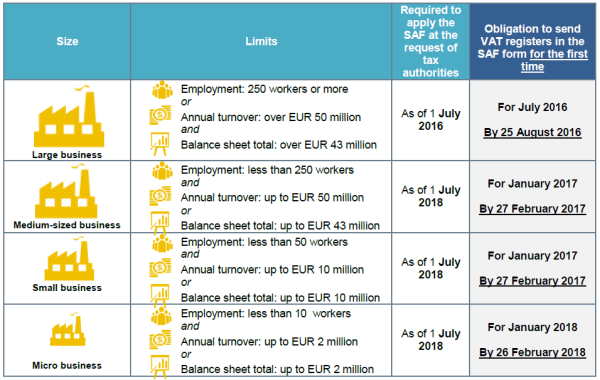

This obligation will apply to the so-called large businesses within the meaning of the Freedom of Business Activity Act as of 1 July 2016.

Small and medium-sized businesses, keeping books of account in an electronic form, will be required to provide tax authorities with information arising from VAT registers in the SAF form every month (without being requested to do so) as of 1 January 2017. This obligation will apply to micro businesses as of 1 January 2018.

|

||||

SAF AT THE REQUEST OF TAX AUTHORITIES |

|||||

|

FORM |

Taxpayers will be required to submit data in the form of the SAF to tax authorities, using means of electronic communication, with secure electronic signature, or data carriers. All data obtained by tax authorities in the form of the SAF will be confidential and protected as information obtained during audit proceedings. As part of the SAF, taxpayers will be required to submit information arising from books of account and accounting documents (e.g. invoices, accounting notes, receipts) taking into consideration the following structures: Books of Account, Bank Statement, Warehouse, VAT Purchase and Sale Records, VAT Invoices, Revenue and Expense Ledger, Revenue Records. |

||||

|

WHO AND WHEN |

As of 1 July 2016, the obligation of submitting documents in the SAF form will apply to the so-called large businesses within the meaning of the Freedom of Business Activity Act. Small and medium-sized businesses will be required to submit the SAF as of 1 July 2018. Until that date, they can submit the SAF at their discretion. |

||||

|

FOREIGN ENTITIES |

The obligation of providing data in the SAF form, both at the request of tax authorities and without such request within the scope arising from VAT registers, will also apply to foreign entities, including entities registered in Poland for VAT purposes only, not having a fixed establishment in Poland. When verifying whether a given foreign entity exceeds statutory thresholds of the business size, its global business activity should be analysed, not only with respect to its activities performed in Poland. | ||||

|

|

The table below presents criteria for classifying businesses into specific groups and dates as of when they will be required to provide data both in the form of monthly SAFs concerning VAT and “complete” SAFs filed at the tax authorities’ request.

|

||||

|

This document has been prepared for information purposes only and is of a general nature. Before taking any action pursuant to the above information, we recommend that you obtain a valid opinion of TPA experts. |

|||||